top of page

Blog

The latest news & insights in the world of fine wine investments.

Search

Why Fine Wine Is a Favourable Alternative Asset.

Fine wine is increasingly recognised as a smart, tax-efficient investment. Offering steady appreciation, protection from inflation, and exemption from capital gains tax in many cases, it provides diversification and long-term security within any investment portfolio.

daniel710549

2 days ago3 min read

Fine Wine, Fine Returns: Why Investors Trust Cellar Advisor for Long-Term Growth: A blog on Fine Wine Investment and Tax Efficiency.

Discover how fine wine investment can protect and grow your wealth. With Cellar Advisor, you gain expert insight, transparent management, and the potential for tax-free capital growth through carefully selected vintages.

daniel710549

Oct 132 min read

Top 5 Fine Wine Investments for 2025: Expert Picks for Savvy Investors

With global demand rising and alternative assets gaining traction, fine wine investment stands out in 2025 for its resilience and returns. Learn which wines are outperforming and how to diversify your holdings in this elite market.

daniel710549

Oct 102 min read

Why Fine Wine Investment Outperforms Equities and Bonds —A Smart Alternative for UK Investors.

Fine wine investment outperforms equities with higher risk-adjusted returns, lower volatility, and potential UK tax-free gains—making it a smart, stable alternative for modern investors.

daniel710549

Oct 64 min read

Fine Wine Investment in 2025:

Fine wine investment is one of the most stable and rewarding alternative assets in 2025. At Cellar Advisor, we help clients build secure, data-driven wine portfolios with access to rare vintages from Bordeaux, Burgundy, Napa, and beyond. With offices in London and Dubai, we combine global reach with local expertise for profitable results.

daniel710549

Oct 23 min read

How to Build a Diversified Fine Wine Investment Portfolio.

Building a diversified fine wine portfolio is essential for reducing risk and maximising returns. By balancing blue-chip Bordeaux and Burgundy wines with emerging regions like Tuscany and Napa Valley, and mixing both strong vintages and undervalued years, investors can achieve stable growth and liquidity.

daniel710549

Sep 282 min read

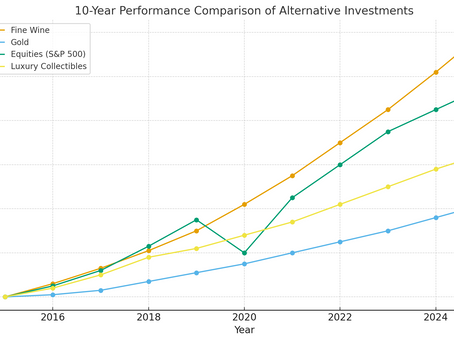

Fine Wine vs Other Alternative Investments: Why Wine Often Comes Out on Top.

Fine wine has quietly become one of the most compelling alternative investments, offering scarcity, stability, and diversification benefits that many traditional assets can’t match. Unlike gold or real estate, fine wine combines tangible value with cultural prestige, while often outperforming equities and other alternatives on a risk-adjusted basis.

daniel710549

Sep 243 min read

Fine Wine Market Update: September 2025.

Fine wine investment continues to attract savvy investors in 2025, thanks to its historical stability, global demand, and tangible asset appeal. As the market recovers and interest in alternative investments grows, building a luxury wine portfolio has never been more relevant. Bordeaux, Burgundy, Champagne, and iconic labels like Lafite Rothschild and Domaine de la Romanée-Conti remain top contenders for long-term return and portfolio diversification.

daniel710549

Sep 192 min read

Super Tuscan Wines: The Investment Opportunity You Can’t Afford to Miss.

Super Tuscan wines are more than just a symbol of Italian winemaking excellence—they’re one of the most exciting opportunities in fine wine investment today. With global demand surging, limited production, and a track record of outperforming traditional regions like Bordeaux, Super Tuscans such as Sassicaia, Tignanello, and Ornellaia are proving to be both collectible and profitable. For new investors looking to enter the world of fine wine.

daniel710549

Sep 142 min read

Top 5 Fine Wine Investments for 2025: Expert Picks for Investors

Fine wine investment continues to attract savvy investors in 2025, thanks to its historical stability, global demand, and tangible asset...

daniel710549

Sep 102 min read

Top 5 Fine Wine Investments for 2025: Expert Picks for Savvy Investors

Fine wine investment continues to attract savvy investors in 2025, thanks to its historical stability, global demand, and tangible asset...

daniel710549

Sep 102 min read

Why Burgundy Fine Wine Is a Compelling Investment: Current Performance & 5–Year Outlook.

Burgundy fine wine, renowned for its prestige and scarcity, is increasingly admired not just by collectors but by savvy investors. In...

daniel710549

Sep 72 min read

Why Fine Wine Outperforms Traditional Markets Over the Long Term.

As an investor in the United Kingdom, you may already be familiar with the volatility of equity markets such as the FTSE 100. But did you know that fine wine, as tracked by Liv-ex, regularly outperforms these markets over both five and ten year horizons? Let us explore why this unique tangible asset continues to shine.

daniel710549

Sep 32 min read

Fine Wine Investment: How Liv-ex Outperforms Traditional Markets

Fine wine has long been associated with luxury, heritage, and celebration. Today it is also recognised as one of the most attractive alternative investments, offering strong returns and resilience compared with traditional markets. With demand growing across Europe, the Middle East, Asia, and North America, fine wine is now firmly established as a serious asset class.

daniel710549

Aug 282 min read

bottom of page